Forget the stigma and shame. Financial expert Bruce Sellery helps you understand bankruptcy and how to decide whether it's the right decision for your family...

- Subject:

- Business

- Financial Literacy

- Material Type:

- Activity/Lab

- Date Added:

- 02/26/2024

Forget the stigma and shame. Financial expert Bruce Sellery helps you understand bankruptcy and how to decide whether it's the right decision for your family...

The material in this lesson will help students become aware of the warning signs of financial difficulties. When difficulties arise, students should first contact their creditors. Next, efforts should be made to revise spending patterns. In addition, assistance from a Credit Counseling service agencies might be considered. What if these actions do not help?

This collection features resources to support teaching Module 6C: Applying Personal Spending Plans from the Saskatchewan Financial Literacy curriculum. In Round 1, students learn to allocate their "20 bean salary" according to which options they want to spend their beans on. Round 2 forces the students to reduce their salary to 13 beans and make decisions about where they should make their "cuts". Round 3 includes some "life happens" challenges that allow students to make more decisions on where to move the beans in order to deal with the situations. This activity completes with some reflection questions on how this activity relates to budgeting with real income.

There are several interesting articles written by Anne Gaviola on Vice focused on Canadian finances, debt, and correlations between money and a person’s well-being. Keeping your debt a secret can mess with your mind and body. The culture of secrecy around debt causes young people to suffer in silence, making it even harder to manage debt. Use this content for case-based learning opportunities.

Venture: Entrepreneurial ExpeditionIntroduce 7th - 10th grade students to the fundamentals of entrepreneurship, from creating a business plan to performing market research, in this food-truck simulation. In this program, students will progress through online (and offline) lessons entitled Building a Budget, The Entrepreneur in You, Planning & Building a Business, Your Business Snapshot.

In this Case Study, students will take on the role of a credit counselor to assist a borrower who finds himself in serious financial distress. Several options will be presented, and students will identify pros and cons of each approach and choose a path forward.

Managing debt loads can be very difficult and overwhelming at times. Hiding from debt and avoiding the problem, will only make the situation worse. This activity includes mini case studies on how to handle various debt problems so that the students can take control of their debt and move forward to a better financial future.

Welcome to the "Keep Your Balance" activity. You are moving out on your own! You will receive no help from home! In this scenario you are old enough to drive a car if you choose to include the expenses of a car in your monthly expenses. You may share accommodation but each person must have his or her own bedroom.

In this vignette the girl is influenced by her peers to make a poor choice. Don’t let others decide what you need and what you want. Every day people are exposed to advertising trying to convince them to buy their product. If you think that what you want is actually something you need, you are more likely to buy it. Money must be spent on needs, but wants are a choice you make. You should be in control of your spending.

Folders upon folders of excellent financial literacy teaching materials!

"It is recommended to start planning instruction with the Teacher’s Guides in each module. If you are seeking a specific resource, scroll below to search."

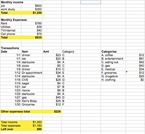

This collection features resources to support teaching Module 6C: Applying Personal Spending Plans from the Saskatchewan Financial Literacy curriculum.This is a full project that can be used in Module 6C for Financial Literacy 30. This usually takes the students about 5 hours to complete and it is very comprehensive to cover all future spending. The assignment requires the students to "screenshot" proof of items they found for their budget (and support each item with evidence). Students really enjoy this project (and adults have used it too for budgeing in real life!). Students may chose to have $0 spending on some items (pets, legal, etc), but they should explain their reasoning for entering a zero. As well, students should enter savings into their budget (at least 10% of earnings).

Use the filters on the left hand side to find the content type, grade level and/or subject that you're after.

This site has many great lessons for Financial Literacy, Business, Math, Social Studies, Arts, ELA, Science and more!

Virtual programs are available!

Budgeting is an important task for money managment. Using a spreadsheet can make this task much easier with tools that autocalculate totals. As well, the spreadsheet can be copied easily for each month or year. Categories can be easily tailored to the users' needs by adding items that are specifc to their financial situation.Budgets are used by non-profit groups, organizations, businesses, sports associations and volunteer groups for their cash flow management. Using a spreadsheet will make budgeting and decision making much easier and transparent for all users. Here is a variety of blank templates and examples that can be used for various budgeting purposes.

This booklet contains 7 chapters on topics related to how to earn, save, budget, spend, borrow, protect and give money. Whether you get a weekly allowance or get paid for walking your neighbor’s dog, your first step in handling your money well is to think about short-term and long-term goals. Then make a plan to reach them. It takes a bit of practice to master your money, just like it takes time to learn to ride a bike. But once you get the hang of it, you’ll be ready to tackle all sorts of money twists and turns.

"The Budget Planner helps you create a customized budget in 3 simple steps. Gather information regarding your income and expenses and get started! If you don’t have all your information, you can always save and continue later.

This tool allows Canadians to create a personalized budget that they can save and update online. It draws on behavioural research into how people make financial decisions, and uses tips, guidelines and suggestions to make budgeting easier. "

Watch this video to get started: https://www.youtube.com/watch?v=eidft2ovmQc&feature=youtu.be (copy and paste this url into your browser).

This activity contains three case studies which allow students to evaluate situations that are considered when budgeting. The students will create budgets for the individuals in the cases as part of this assignment.

Examine the principles of budgeting.

Teacher's guide included.

3-5 hours

Find resources, events, tools and information on budgeting, money management, insurance, saving, investing, and taxes from various Canadian organizations.

This content contains grade level Personal Finance Case Studies, resources to help teachers teach, helpful guides for teachers to write their own case studies and sample case presentations and videos of past students. These are great resources to enhance your teachings, use as projects or year end assignments and to prepare students for case based instruction in their future post secondary or at case competitions.

Students will learn the consequences of not paying one’s debts and the choices of last resort for out-of-control debt. Students will explain how using [types of predatory loans] can cause a vicious cycle of debt. Bankruptcy is also introduced, and the various costs associated with bankruptcy are outlined. The students will discover what steps a person can take to avoid filing for bankruptcy, including seeing a credit counselor.